Got questions?

Call Lisa 336-416-6821

Email [email protected]

Or Visit www.thepreserve-winstonsalem.com

Financing Your Custom Home

An overview of residential lot and construction-to-permanent financing for buyers at THE PRESERVE At Robinhood Ridge.

Building a custom home involves a different financing structure than purchasing an existing home, and understanding it early can help everything move more smoothly. At The Preserve at Robinhood Ridge, construction-to-permanent financing allows the lot purchase and construction to be planned together, with funding released in stages and conversion to a permanent mortgage once the home is complete.

This high-level overview is designed to help you understand the financing process, what to expect at each stage, and how to prepare before you begin..

How Custom Home Financing Works

The Construction-to-Permanent Financing Process

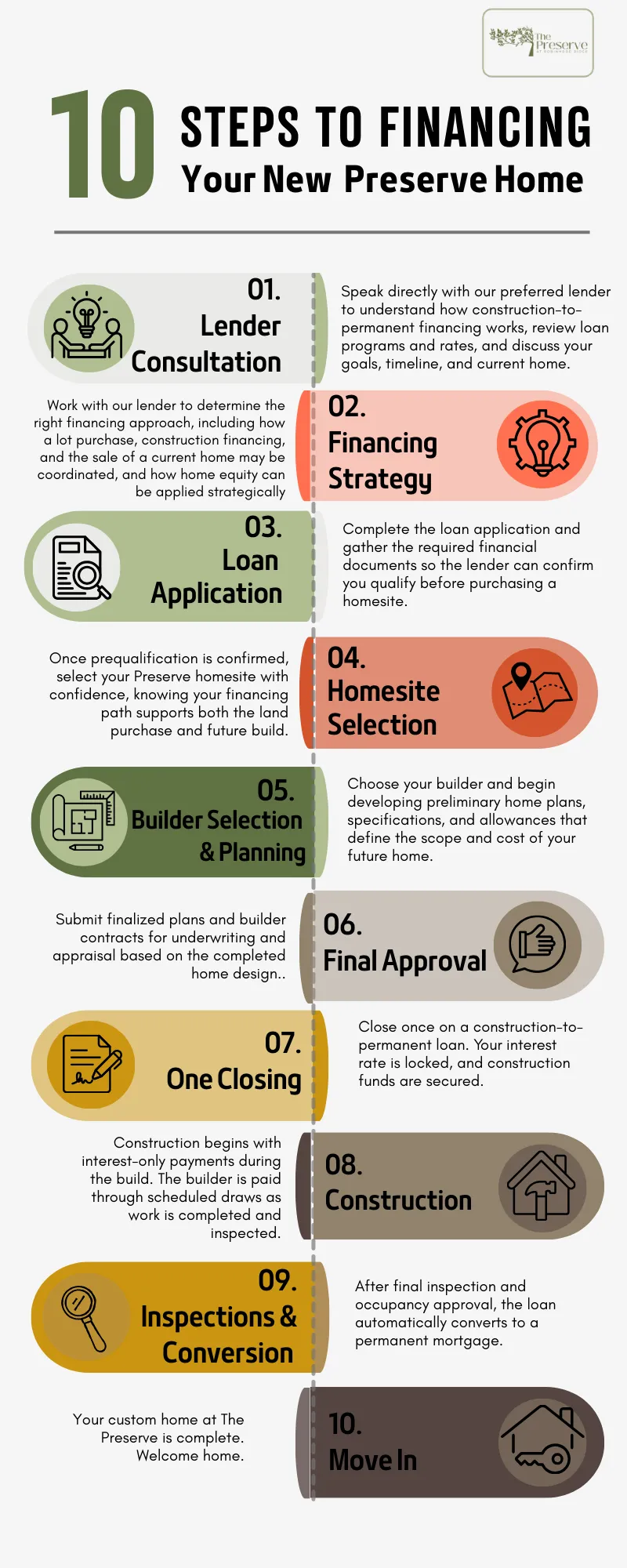

Once you understand the overall structure of custom home financing, the process itself follows a clear sequence. Construction-to-permanent financing is designed to guide you from early planning through construction and ultimately to move-in day.

The steps shown here outline the typical financing journey, beginning with an initial consultation and moving through pre-qualification, construction funding, inspections, and final loan conversion.

While every build is unique, this framework helps set expectations and provides a clear roadmap for what happens at each stage.

Step 1: Lender Consultation

The first—and most important—step in the construction financing process is the initial consultation with an experienced lender. This conversation is designed to help you understand how construction-to-permanent financing works and determine whether it’s a good fit before moving forward.

During this step, you’ll review loan programs, estimated rates, and overall financing strategies. If you currently own a home and plan to sell it when your new home is complete, this discussion may also include how existing equity could be applied and whether a future loan recast could help reduce the final loan balance and monthly payment.

A pre-qualification is typically completed at this stage to confirm basic eligibility and help establish a realistic framework for next steps. This early planning helps ensure clarity and alignment before decisions are made about homesites, builders, or design.

Preferred Construction Lender

Introducing Walt Morton

Mortgage Banking Specialist | First National Bank

NMLS #659108

Walt Morton is the preferred construction lender for The Preserve at Robinhood Ridge and a Mortgage Banking Specialist with First National Bank. With more than 40 years of experience in mortgage lending,

Walt specializes in residential lot financing and construction-to-permanent loans for buyers building custom homes. Based in Winston-Salem, he works closely with builders, appraisers, and inspectors to help guide the financing process from planning through completion.

Walt’s approach is focused on clarity, early planning, and helping clients understand each step of the construction loan process.

Schedule a consultation with Walt

email: [email protected]

Cell: 336-813-1495

This will take you to the First National Bank website where you can schedule a consultation, learn more and apply for a loan with Walt.

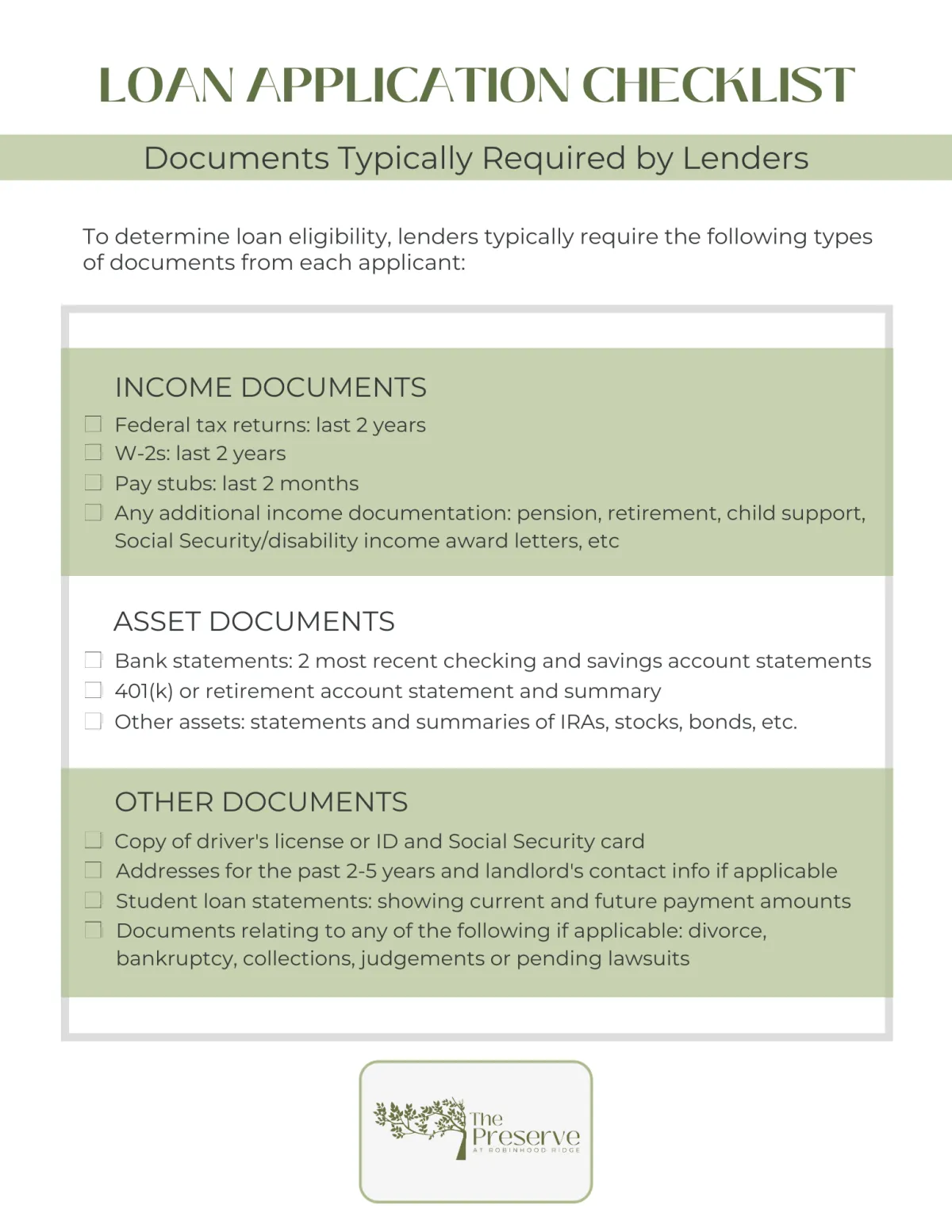

Documents You May Be Asked to Provide

After the initial consultation and pre-qualification, you may be asked to provide standard financial documentation so the lender can complete a more detailed review and issue a pre-approval. Gathering these items early helps keep the process moving smoothly once plans, contracts, and timelines are in place.

The documents requested are typical of most mortgage applications and help confirm income, assets, and overall financial qualifications. Having them ready in advance can save time and reduce stress as you move forward in the process.

Not all documents are required upfront, and your lender will guide you through what’s needed and when.

Got questions?

Call Lisa 336-416-6821

Email [email protected]

or visit our website:

www.thepreserve-winstonsalem.com

© 2025 The Preserve at Robinhood Ridge.

All Rights Reserved.

Presented by Lolabell Holdings LLC · Marketing & Creative Direction by Brightline Ideas

© 2025 The Preserve at Robinhood Ridge.

All Rights Reserved.

Got questions?